Algo Trading |

July 27, 2020The Growth and Future of Algorithmic Trading

Algo trading is all about an algorithm trading on your behalf. Introduced in India on April 3, 2008, it is gaining popularity among both domestic and foreign institutional investors, brokers, and other stock market traders.

Algo trading in India was first introduced by the Securities and Exchange Board of India (SEBI) through the Direct Market Access (DMA) facility. This facility allowed brokers to provide their infrastructure to clients so that they can access the trading system.

This was the advent of algorithmic trading in India.

First offered to institutional investors, algo trading in India helped:

- Reduce costs

- Improve execution

- Cut down the time spent in routing the order to the broker

- Generate better returns

Later in Feb. 2009, Foreign Institutional Investors (FIIs) started using the DMA facility through investment managers. Then, financial technology companies introduced algorithmic trading platforms in India.

And since then, there has been no turning back for algo trading platforms.

Today, a lot of trade is done using pre-designed algorithms—pre-set index levels, quantitative indicators, or arbitrage opportunities. These programs running on computers can automatically place trades, efficiently manage portfolios, and generate good returns without any significant manual intervention.

And the best part?

Using the right algo trading platforms and programs can help you generate profits at a speed and at a frequency that is nearly impossible to achieve for any human trader.

In India, most traders use automated software programs and Application Programming Interfaces (APIs) to place orders according to their preferred trading strategy. Investors program their algorithms and then execute them with the help of a broker.

One of the primary reasons behind the booming algo trading industry in India is that algo trading is strictly mechanical and follows strict pre-designed parameters to enter and exit trades. This helps investors eliminate the emotional pitfalls that human traders can encounter while making trading decisions.

Also, your trading algorithms can keep running 24 hours a day, without getting tired.

The global algorithmic trading market is expected to grow significantly by 2026 due to the emergence of cloud-based services for algo trading. In fact, 37% of financial institutions in India are investing in AI and algo trading to make the most of this growth.

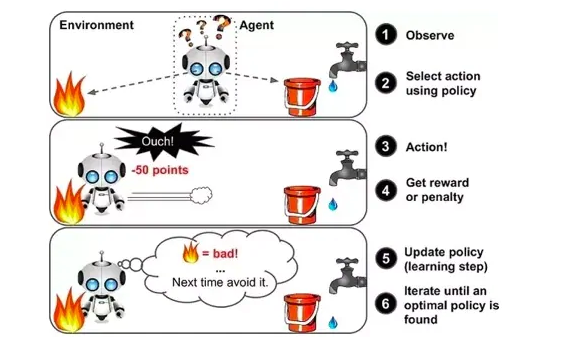

With the use of AI, algorithms will:

- Learn from their past trading experiences and mistakes.

- Adapt to market conditions

- Reduce risk

- And make informed trading decisions

- Generate more profits

Here’s a flowchart that will help you understand how AI-powered algorithms can be your best bet during stock trading:

AI-powered algorithms and automated algo trading platforms can help you trade responsibly and grow your wealth.

Manual trading methods will never be able to meet the speed, accuracy, and results that algorithmic trading can offer. That’s why we can confidently say that algorithmic trading and automation have a bright future in India (and globally).

However, you need to choose the right algorithms to achieve good returns. Feel free to get in touch with our certified algo trading experts in India before making any investment decisions.